January 2022 is a Seller's market!

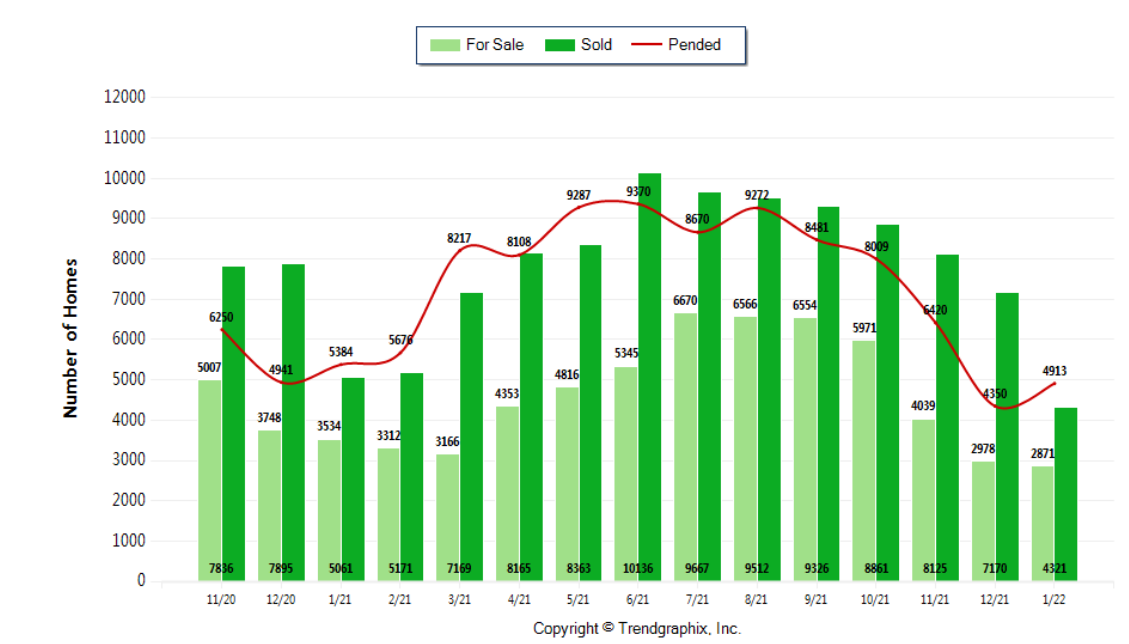

The number of for sale listings was down 18.8% from one year earlier and down 3.6% from the previous month. The number of sold listings decreased 14.6% year over year and decreased 39.7% month over month. The number of under contract listings was up 12.9% compared to previous month and down 8.7% compared to previous year. The Months of Inventory based on Closed Sales is 0.7, the same as the previous year.

The Average Sold Price per Square Footage was down 2.2% compared to previous month and up 17.2% compared to last year. The Median Sold Price decreased by 2.5% from last month. The Average Sold Price also decreased by 5.2% from last month. Based on the 6 month trend, the Average Sold Price trend is "Depreciating" and the Median Sold Price trend is "Depreciating".

The Average Days on Market showed a upward trend, a decrease of 17.2% compared to previous year. The ratio of Sold Price vs. Original List Price is 103%, an increase of 2% compared to previous year

It is a Seller's Market

Property Sales (Sold)

January property sales were 4321, down 14.6% from 5061 in January of 2021 and 39.7% lower than the 7170 sales last month.

Current Inventory (For Sale)

Versus last year, the total number of properties available this month is lower by 663 units of 18.8%. This year's smaller inventory means that buyers who waitedto buy may have smaller selection to choose from. The number of currentinventory is down 3.6% compared to the previous month.

Property Under Contract (Pended)

There was an increase of 12.9% in the pended properties in January, with 4913 properties versus 4350 last month. This month's pended property sales were 8.7% lower than at this time last year.

A frigid first week of January, surges in coronavirus cases, and depleted inventory were among factors of last month’s slower than year-ago sales. In newly released statistics for January, the MLS reported a drop of 14% pending sales of single family homes and condominiums during January, about 1,000 fewer the same month a year ago. The year-over-year (YOY) number of closed sales also fell, dropping from 5,896 completed transactions to 5,085 for a decline of nearly 13.8%.

When there’s uncertainty, the default position for most sellers is to stay put, do nothing, and hunker down. Many things are contributing to sellers’ reluctance to put their homes on the market, most notably, COVID, inflation, the economy, the holidays, and finding a replacement property. Security and certainty are more important than cashing in on record amounts of equity. New listings are added during January, nearly 1,000 fewer than the same month a year ago, but an improvement on December’s volume of 4617. Only five counties reported YOY gains in new listings.

Last month’s pending sales outgained new listings to further shrink inventory. At month end the selection included a meager 3,092 active listings, down more than 30% from a year ago. There is about 2.5 weeks of supply (0.61 months) across the 26 counties served by Northwest MLS. King County had the steepest drop in active listings, shrinking nearly 59% from a year ago, followed by Snohomish County, down more than 35%. A comparison of counties in the listing service report shows only about half of them have more than one month of supply, and these areas tend to be in more rural areas. King, Pierce, and Snohomish counties all have less than two weeks of supply.

The year started off with more of a whimper than a boom thanks to listing inventory in King, Pierce, and Snohomish counties being lower than any January on record. The market remains virtually sold out, and there is a significant backlog of buyers looking for a home to purchase. With higher mortgage rates expected, buyers are more anxious to get a home, even during the inventory shortage. Given the market conditions, nearly all homes are going under contract within a week of being listed, and multiple offers are commonplace in price ranges where there is a shortage of available homes for sale

The market in Seattle continues to be extremely competitive with multiple offers and prices escalating. The imminent rise in interest rates has buyers scrambling to find properties to buy. Rates are still historically low. Expected increases may be spooking some buyers, but it’s also getting others off the fence. The market is crazy. Huge increases in median sales prices and a continued lowering of the number of days homes are on the market. The massive reduction in inventory has led to fewer pending sales and super-charged prices. Many properties have literally gained 40%-to-50% appreciation in just the last two years or so – a rate of increase no one can comfortably live with.

Forbearance across the U.S. is below 800,000 units, down from over 4.5 million in 2020. Despite the slow start in sales and persistent shortages of inventory, expect a robust activity during 2022. The market dipped slightly in January, mainly due to weather and concerns over the latest pandemic variant, but the general feeling is that it’s going to be a good year. Last year’s record-setting volume of closings, rate increases during 2022 combined with the sunset of the pandemic will bring more sellers to the market.

People waiting longer to sell their home should not expect the same steep price increases we were seeing in 2021. An influx of people coming to the market and a decrease in the buyer pool due to interest rates going up should help to keep prices level. Rising mortgage rates and the addition of inventory as spring arrives should bring more opportunities for buyers. Many buyers are considering homes farther north, south and east with more affordable prices and more selection. Hybrid work-from-home conditions are allowing more flexibility for buyers. Job demand and lifestyle choices continue to drive sales.

One of the biggest questions for 2022 is how the market will be further impacted by the work-from-home paradigm given that many companies have postponed their long-term WFH plans. This is likely holding back sellers during a time when we desperately need additional inventory, as well as buyers who are concerned about rising mortgage rates. Expect more sellers will list their homes and more buyers will start their searches once they know how often they need to commute to work, and this may lead to a busier spring market than expected. There will not be any substantive market changes, come spring, except for higher interest rates. But someone please explain that to a desperate buyer willing to pay more, accept less, and be glad they did.

If you think you are saving money by waiting, you should run the numbers. Economists and pundits in real estate all say buy now. The anticipated increase in equity across the next two-to-four years will be astonishing.

Know the Top 5 Things You Need To Ask For When Getting Mortgage Rates.

George Moorhead of Bentley Properties talks about Inflations Causing Rates To Go Up and Is The Real Estate Market Crashing? Plus, Top 5 Things You Need To Look For When Getting Mortgage Rates.

For more Real Estate News and Tips, please tune in to our Facebook Live every Saturday at 10AM

Follow us on Facebook: George Moorhead Bentley Properties

If you have any questions or comments you would like answered in next month's newsletter, email me at [email protected] and they will be included in the market update. OR if you would like more information on our unique systems and programs, call us at 425-236-6777 Or visit our website www.GeorgeMoorhead.com

GEORGE MOORHEAD - Bentley Properties

[email protected]

Direct: 425-236-6777

14205 SE 36th St., Suite 100, Bellevue WA 98006

www.GeorgeMoorhead.com